- Urban 411

- Posts

- Your Weekly 411: Upcoming Interest Rate Drop | Home Prices To Drop Up To 5% This Winter | Changes to Mortgage Stress Test | Wave of Mortgage Renewals

Your Weekly 411: Upcoming Interest Rate Drop | Home Prices To Drop Up To 5% This Winter | Changes to Mortgage Stress Test | Wave of Mortgage Renewals

Wave of Mortgage Renewals

The Weekly 411 TLDR: 🌇 Hope in Sight: Bank Mentions Upcoming Interest Rate Drop 📉 Wave of Mortgage Renewals Can Force Banks to Lower Rates ❄️ Home Prices To Drop Up To 5% This Winter 📜 Potential Changes to Mortgage Stress Test and Short-Term Rental 🤑 Home Savings Account to Help First-time Homebuyers |

🌇 Hope in Sight: Bank Mentions Upcoming Interest Rate Drop

The governor of the Bank of Canada said yesterday that borrowing costs might not increase for a while.

The bank believes that interest rates may currently be high enough to control prices.

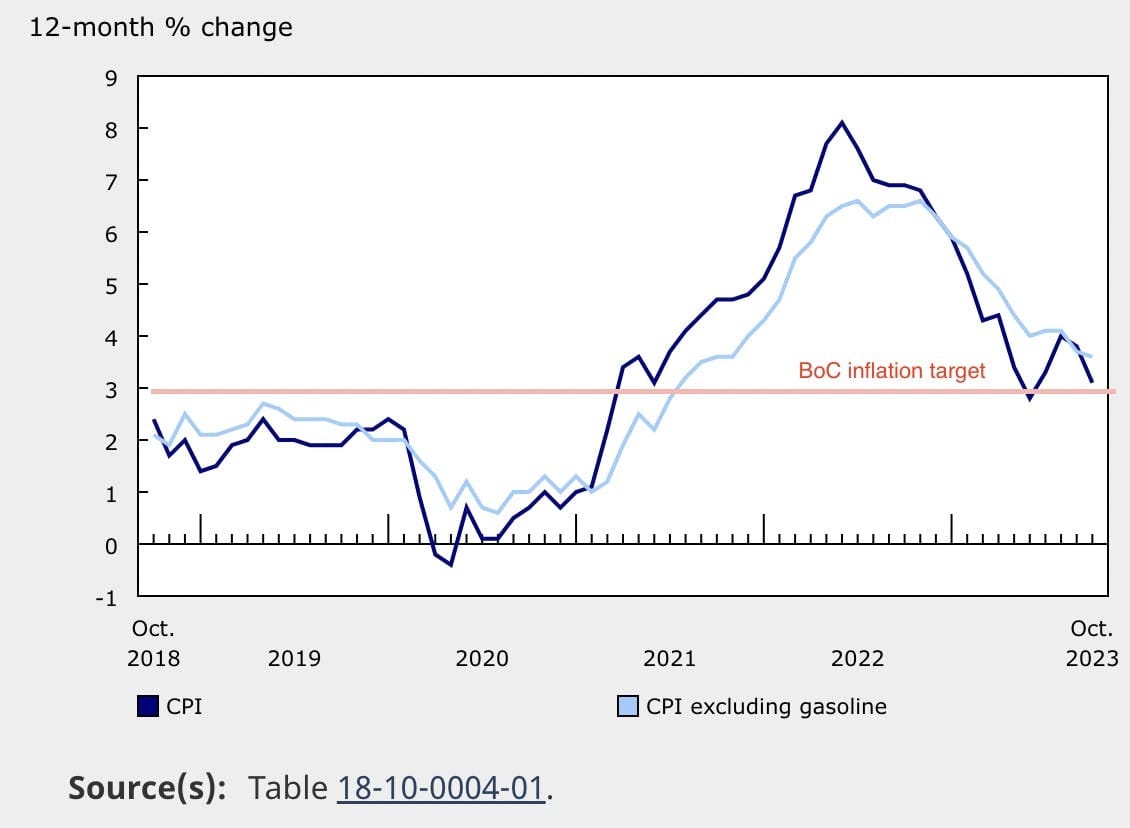

CPI (consumer price index) went up by 3.1% in October, the slowest pace since June

The Bank is prepared to raise rates again if inflation remains high.

Why This Matters: The Bank of Canada's decision to maintain rates and the expectation of potential easing will reduce borrowing costs and increase real estate activity. While they currently expect inflation to slow down in 5-7 months, there are risks that it may not happen as quickly as anticipated.

Bank of Canada Governor, Tiff Macklem |

📉 Wave of Mortgage Renewals May Force Bank of Canada to Lower Interest Rates

About 60% of the mortgage market will undergo renewal over the next three years, making it critical for the bank to lower rates in 2024

Analysts predict that rates will be cut before 2025 and could be lower than the current 3.8% with a target of 2.5% in 2026.

Inflation needs to be below 3%, and unemployment should be around 6% before the bank can cut rates.

In Canada, shelter and mortgage costs are calculated in inflationary numbers, and subtracting those suggests that 3% inflation is actually 2%.

The slowdown of inflation was largely a result of lower prices for gasoline which dropped by 7.1% in October

Why This Matters: We may move into a seller's market in the second half of 2024. The central bank is unlikely to raise interest rates until 2024 and the economy is expected to move in a positive direction, further rate hikes are possible but unlikely. With nearly 60% of the mortgage market undergoing renewal in the next three years, the BoC may need to start reducing rates as early as Q2 2024 with the goal of reaching an interest rate of 2.5% in 2025.

Change in the Consumer Price Index (CPI)

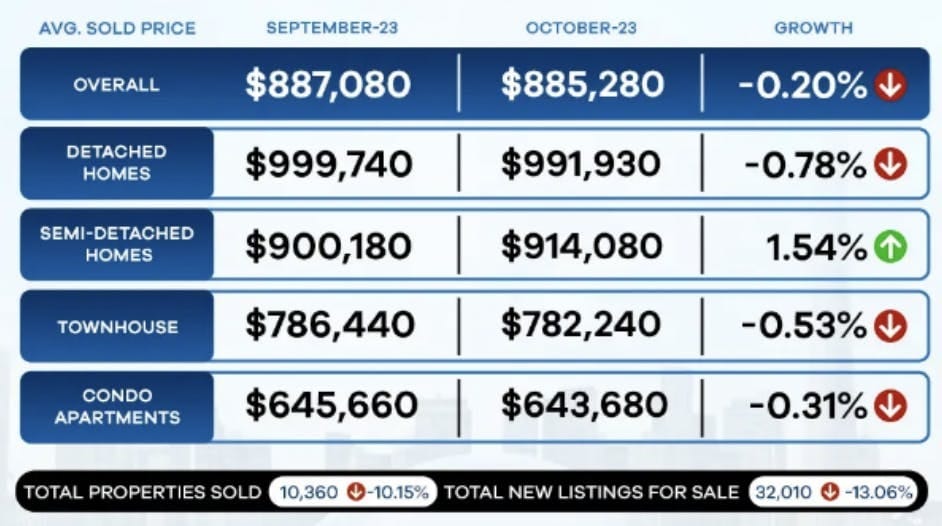

❄️ Home Prices To Drop Up To 5% This Winter

Economists predict a 3% to 5% decrease in home prices for the upcoming winter season.

The Bank of Canada expects to keep interest rates steady through the winter, creating a prime opportunity for homebuyers.

Prices for detached units in Ontario (outside of GTA) have become more affordable with Niagara, London, and Kitchener starting at $539K.

In Oshawa, Scugog, and Uxbridge detached homes are priced between $700K-$800K.

Ontario's housing market is currently in a buyers' market, with a 14.5% decline in property transactions, an 8.2% drop in average home selling prices, and a 21% increase in the time required to sell a house.

Why This Matters: With a decline in property transactions, lower average home prices, and increased time required to sell a house, buyers are able to negotiate better deals this winter. Sellers often hesitate to list their homes during the winter months due to historically slower market activity. However, there is a potential for prices to increase if demand surpasses the available inventory.

📜 Potential Changes to Mortgage Stress Test and Short-Term Rentals

The government plans to introduce new policies that set new expectations for lenders.

Homeowners with an insured mortgage up for renewal won't need to requalify at the minimum qualifying rate (stress test) if they switch lenders.

The stress test currently requires applicants to qualify for a mortgage at rates higher than the actual borrowing rate.

More efforts will be introduced to regulate short-term rental platforms (such as AirBnB) and free up housing supply.

Why This Matters: The stress test limits the ability of potential homebuyers to shop around for better rates by requiring them to qualify for a mortgage at rates higher than the actual borrowing rate. The stress test has been criticized because it results in borrowers opting for higher interest rate mortgages to qualify for a lower-priced home, resulting in more interest paid over the life of the mortgage.

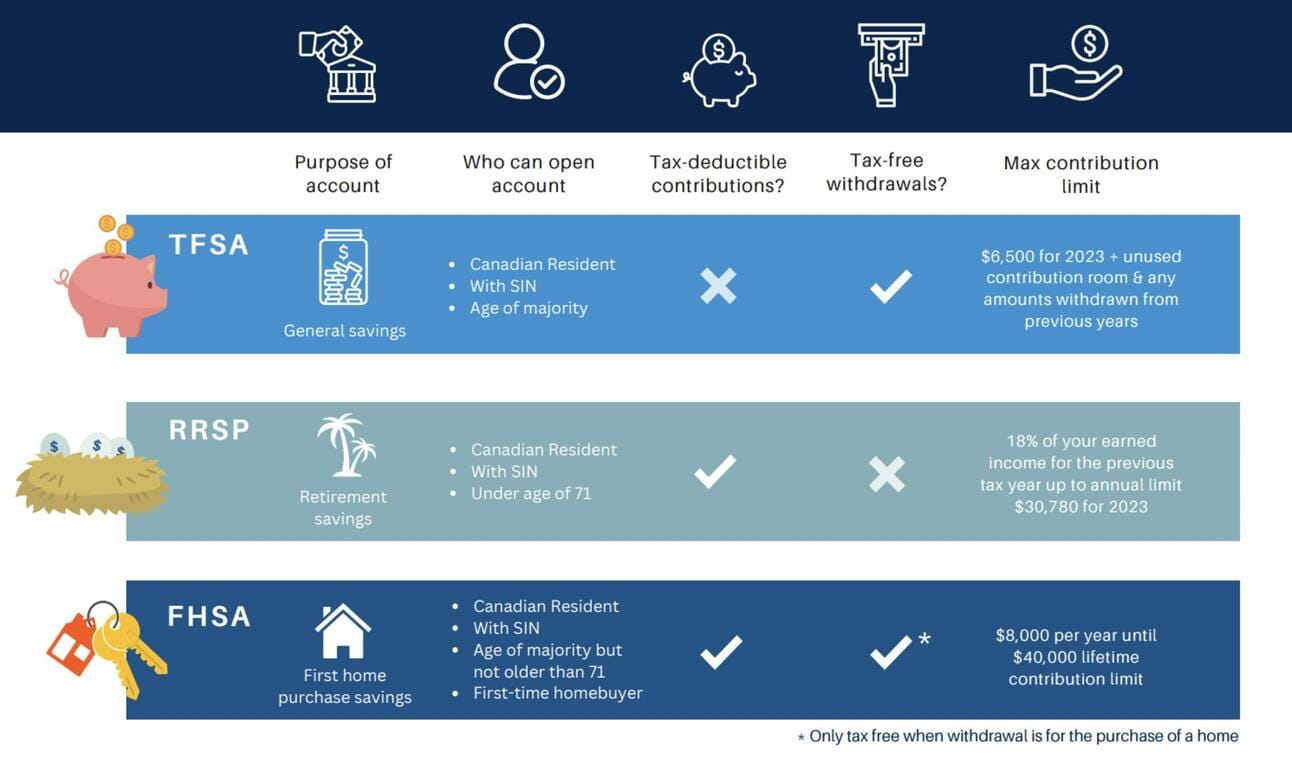

🤑First Home Savings Account to Help First-time Homebuyers

Major Canadian banks offer the First Home Savings Account, assisting first-time homebuyers in saving for a down payment.

Account holders can save up to $40,000 and receive a government match of up to $10,000.

Eligibility criteria include being a Canadian resident, aged 18 or older, and a first-time homebuyer.

Contributions can be made for four years, with a government match calculated at a 5% annual rate.

Funds can only be used for a home down payment and any unused funds are returned after 10 years.

Why This Matters: This program addresses the challenge of saving for a down payment, particularly in Toronto's high-priced market. The government matching contribution of up to $10,000 accelerates savings and makes homeownership more achievable.