- Urban 411

- Posts

- Your Weekly 411: Real Estate Assets to Watch in 2024 | Aging Population Influencing the Real Estate Market| $1.2B in New Loans for Rental Construction in Toronto

Your Weekly 411: Real Estate Assets to Watch in 2024 | Aging Population Influencing the Real Estate Market| $1.2B in New Loans for Rental Construction in Toronto

$1.2B in New Loans for Rental Construction in Toronto

Your Weekly 411 TLDR: 🌇 Real Estate Assets to Watch in 2024 💸 Fed Announces $1.2B in Loans to Drive Rental Construction 👴 Canada's Aging Population Influencing the Real Estate Market 🏘 Surge in Toronto Home Sales Ahead of 2024 Luxury Tax Changes 🤑 Homebuyers Gain Leverage in Canada's Priciest Markets |

🌇 Real Estate Assets to Watch in 2024

Industrial, multifamily, and retail asset classes are identified as the top opportunities for real estate investors in 2024.

These asset classes possess strong fundamentals including low vacancy rates and high demand.

The aging and limited industrial infrastructure in Canadian markets enhances the appeal of the industrial asset class.

Recent government policy changes, such as the GST rebate on new rental projects, generate further industry interest in the multifamily class.

Niche assets within the multifamily segment, such as student and senior housing, are in high demand and present investment prospects.

Why This Matters: Real estate debt funds provide investors with exposure to a diversified pool of real estate assets without the need to acquire or manage the properties. They offer a steady stream of income through interest payments, making them an attractive investment option. This is relevant for investors who want to optimize their real estate investments by repositioning their portfolios.

💸 Fed Announces $1.2B in Loans to Drive Rental Construction in Toronto

The federal government announced on Tuesday that it will provide $1.2 billion in low-interest loans to build over 2,600 rental homes in Toronto.

The loan aims to create 71,000 new rental housing units across Canada by 2027-28.

The funded projects in Toronto will result in the construction of 2,644 rental homes located close to transit, work, and schools. Toronto plans to build 65,000 more rent-controlled homes by 2030.

List of Funded New Projects

855 homes at 373 Front Street East, $444 million invested

484 homes at 94 Eastdale Avenue, $215 million invested

389 homes at 55 Broadway Avenue, $165.4 million invested

390 homes at 325 Moriyama Drive, $130 million invested

233 homes at 1555 Queen Street East, $126 million invested

225 homes at 610 Martin Grove Road, $93.7 million invested

68 homes at 650 Kingston Road, $34.1 million invested

Why This Matters: The funding aims to boost the supply of affordable rental housing, which can attract potential tenants and generate lucrative rental income for investors. Additionally, home buyers seeking rental properties as investment opportunities can benefit from the increased availability of purpose-built rental homes in Toronto.

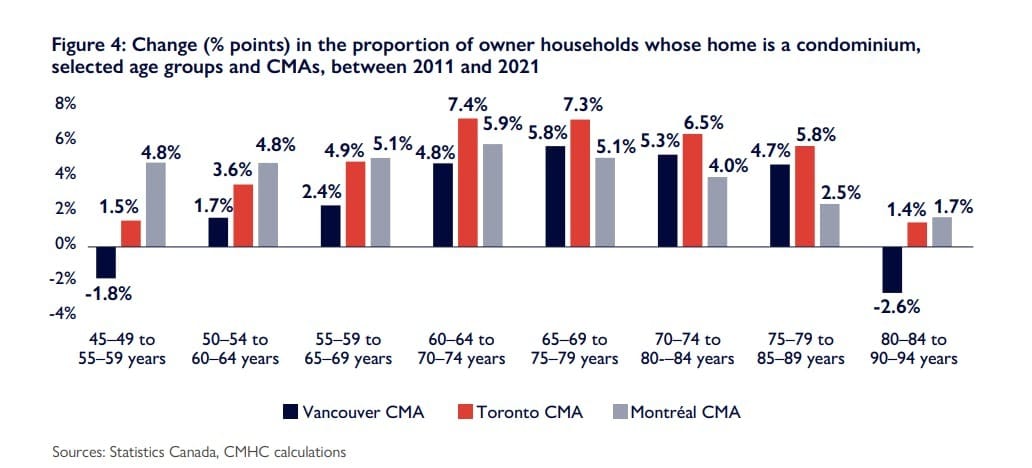

👴👩🦳️ Canada's Aging Population is Influencing the Real Estate Market

More senior households opting to age in place rather than downsizing.

The majority of elderly households in Canada remain homeowners until they reach their 95-to-99-year-old stage.

The trend towards aging in place is resulting in less turnover of homes, reducing the inventory of houses available to first-time buyers.

The sell rate for households aged 75 and over has been decreasing since the early 1990s, falling from 41.6% to 36.0%.

Why This Matters: Understanding how populations age and the factors that influence aging homeowners to sell or stay in their homes can help investors and buyers make informed decisions about their real estate purchases.

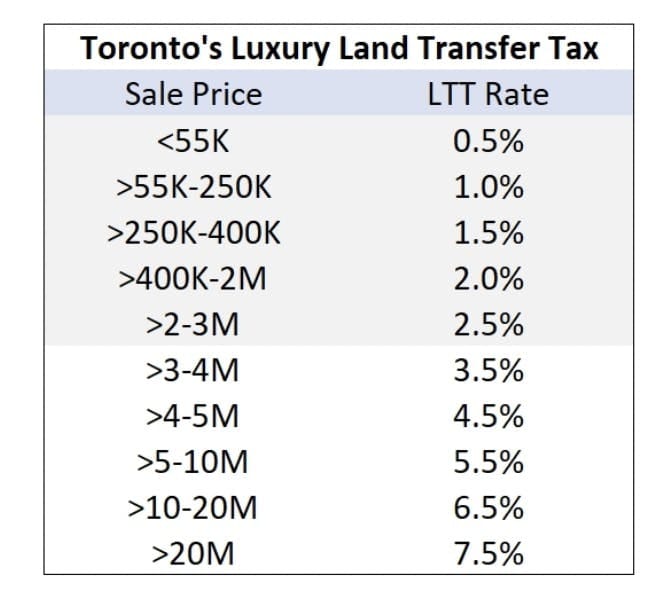

🏘 Surge in Toronto Home Sales Ahead of 2024 Luxury Tax Changes

Toronto's city council approved an increase to land transfer tax rates for homes valued at $3M+ starting January 2024.

Buyers of luxury properties are motivated to avoid the increased tax rates leading to an increase in high-value property transactions in Toronto.

Houses in Rosedale, Forest Hill, and the Bridle Path have seen relatively quick closings before the end of the year.

In September to November, there were six properties sold above the $10 million mark, compared to zero in the same period last year.

It is unusual to see houses closing in December due to the holidays and winter weather conditions.

Buyers of higher-end homes often do not rely on financing and are not as affected by interest rates.

Why This Matters: Investors and buyers interested in luxury properties should consider entering the market before the tax change takes effect. It's also recommended that sellers keep properties listed until the end of the year to attract buyers seeking to avoid the tax increase.

New Luxury Land Transfer Taxes Going into Effect in January 2024

🤑 Homebuyers Gain Leverage in Canada's Priciest Markets

Buyers who qualify for a mortgage amid higher interest rates have been able to extract lower prices in Ontario, Quebec, and British Columbia.

Calgary remains Canada’s hottest market with an unprecedented rise in property prices.

Sales activity for Toronto's real estate market in October 2023 was the worst in 25 years.

Vancouver's residential real estate sales figures have declined below the levels seen during the same period last year.

Why This Matters: Buyers are able to negotiate lower prices in some of Canada's most expensive markets, however, prices in Calgary continue to rise. High interest rates, affordability issues, and the possibility of a recession make it crucial to exercise caution and strategic planning when navigating the real estate market in Canada.