- Urban 411

- Posts

- Your Weekly 411: 6 Planned Transit-oriented communities | Cottage Country Buying Opportunities| Toronto's Vacant Land Deficit

Your Weekly 411: 6 Planned Transit-oriented communities | Cottage Country Buying Opportunities| Toronto's Vacant Land Deficit

Toronto's Vacant Land Deficit

Your Weekly 411 TLDR: 💡 Six Planned Transit-Oriented Communities 🌆 Toronto's Vacant Land Deficit 🏞 Opportunities for Buyers in Ontario's Cottage Country 🤔 Bank of Canada keeps rates at 5% |

💡 Six Planned Transit-Oriented Communities

Ontario Line

Cosburn Station: 620 new residential units and retail space,

Eastern Avenue: 140 new residential units and pedestrian access to the East Harbour Transit Hub.

Gerrard-Carlaw South: 1,310 new residential units, commercial space, and transit connectivity.

Pape Station: New retail and office space and direct transit access. Proposed 496 residential unit.

Thorncliffe Park: Up to 2,660 residential units, public spaces, and a transit plaza

Scarborough Subway Extension

770 residential units, green spaces, and pedestrian connections to a transit plaza.

Why it matters: Investing in transit-oriented communities can offer a smart way to align your investments with urbanization trends. With the increasing focus on sustainable, accessible living, such properties can have long-term potential

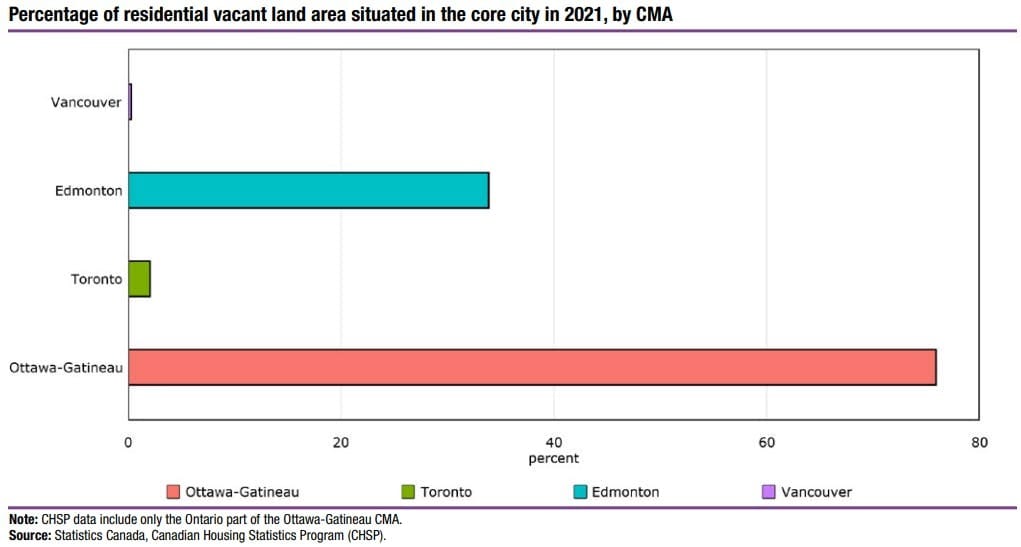

🌆 Toronto's Vacant Land Deficit

Toronto has about 9% vacant land, with only 2.1% in the core.

Vacant land in Toronto is relatively lower compared to regions like Ottawa (18%) and Vancouver (4.5%)

Experts say the issue is more about financing, real estate market conditions, and infrastructure.

Why it matters: With only 9% available and most of it outside the city core. It underscores the need for creative solutions to address housing challenges in a growing population and emphasizes the importance of optimizing existing infrastructure to meet housing demands.

🏞 Opportunities for Buyers in Ontario's Cottage Country

Year-to-date waterfront sales in Ontario are down 5.1% in 2023, while non-waterfront sales are down 7.8%.

The overall market in the Lakelands region is leaning towards a buyers' market.

Muskoka is faring better than other cottage country markets

Despite challenging selling conditions, many cottage country property owners are choosing to sell and downsize instead of passing the properties down to their children.

The decision to sell is driven by affordability concerns, as they can't afford taxes, utilities, and maintenance.

Why it matters: Muskoka is faring better than other cottage country markets. The slowdown in demand and inflationary pressures present a favorable buying opportunity for investors looking to acquire waterfront properties. With an influx of high-end listings and property price reductions, investors can seize the potential for long-term appreciation and rental income.

🤔 Bank of Canada keeps rates at 5%

Canadian economic growth averaged 1% this year, expected to remain weak in 2024, picking up to 2.5% in 2025.

Inflation at 3.8% in September, expected to ease to 2% by 2025.

Possible rate hikes if inflation rises.

Next rate announcement on December 6, next Monetary Policy Report on January 24.

Why it matters: With Canadian economic growth projected to average 1% this year and inflation currently at 3.8%, the expectation of easing inflation to 2% by 2025 provides some reassurance. Keeping track of upcoming rate announcements, such as the one scheduled for December 6, and monitoring the next Monetary Policy Report on January 24 is crucial for investors to make informed decisions