- Urban 411

- Posts

- Your Weekly 411: Investors Account for 30% of Home Purchases in Canada | The Impact of Canada's Foreign Buyer Ban | Hydrogen Industry Drives Real Estate in Alberta

Your Weekly 411: Investors Account for 30% of Home Purchases in Canada | The Impact of Canada's Foreign Buyer Ban | Hydrogen Industry Drives Real Estate in Alberta

Hydrogen Industry Drives Real Estate in Alberta

The Weekly 411

TLDR:

💸 Report: Investors Account for 30% of Home Purchases in Canada

🚫 The Impact of Canada's Foreign Buyer Ban on Housing Affordability

🏢 Commercial Real Estate Outlook for 2024

🛖 Why Now is a Great Time to Buy a Cottage

🏭 Hydrogen Industry Drives Real Estate Opportunities in Alberta

💸 Report: Investors Account for 30% of Home Purchases in Canada

This year, investors accounted for 30% of home purchases, up from 28% in 2022 and 22% in 2020.

The proportion of first-time homebuyers decreased to 43% in the first quarter of this year, down from 48%.

Repeat buyers also decreased to 27.5% from 30% over the same period.

Home flipping has been on the rise, but represents less than 3% of transactions.

Why This Matters: While the government has targeted foreign real estate buyers with a ban on purchases, no specific measures have been taken to address individual domestic real estate investors.

The presence of investors can amplify price cycles by adding bidding pressures during housing booms and downward pressures during stable or declining periods.

🚫 The Impact of Canada's Foreign Buyer Ban on Housing Affordability

The ban on foreign buyers in Canada, implemented in 2022, has not resulted in more affordable housing for Canadians.

While the ban initially led to a drop in high-end home prices, the real driver of price fluctuations has been interest rates and economic slowdown.

Critics argue that Canada's ban on foreign buyers had loopholes and should have been more strict, citing examples like Hong Kong and Singapore with higher taxes and stricter buyer restrictions.

Why This Matters: The foreign buyer ban had numerous exemptions and was more of a political move than an effective solution to housing affordability.

Success stories like Singapore, with aggressive speculation taxes and a robust public housing system, provide insights for Canada to learn from in addressing affordability concerns.

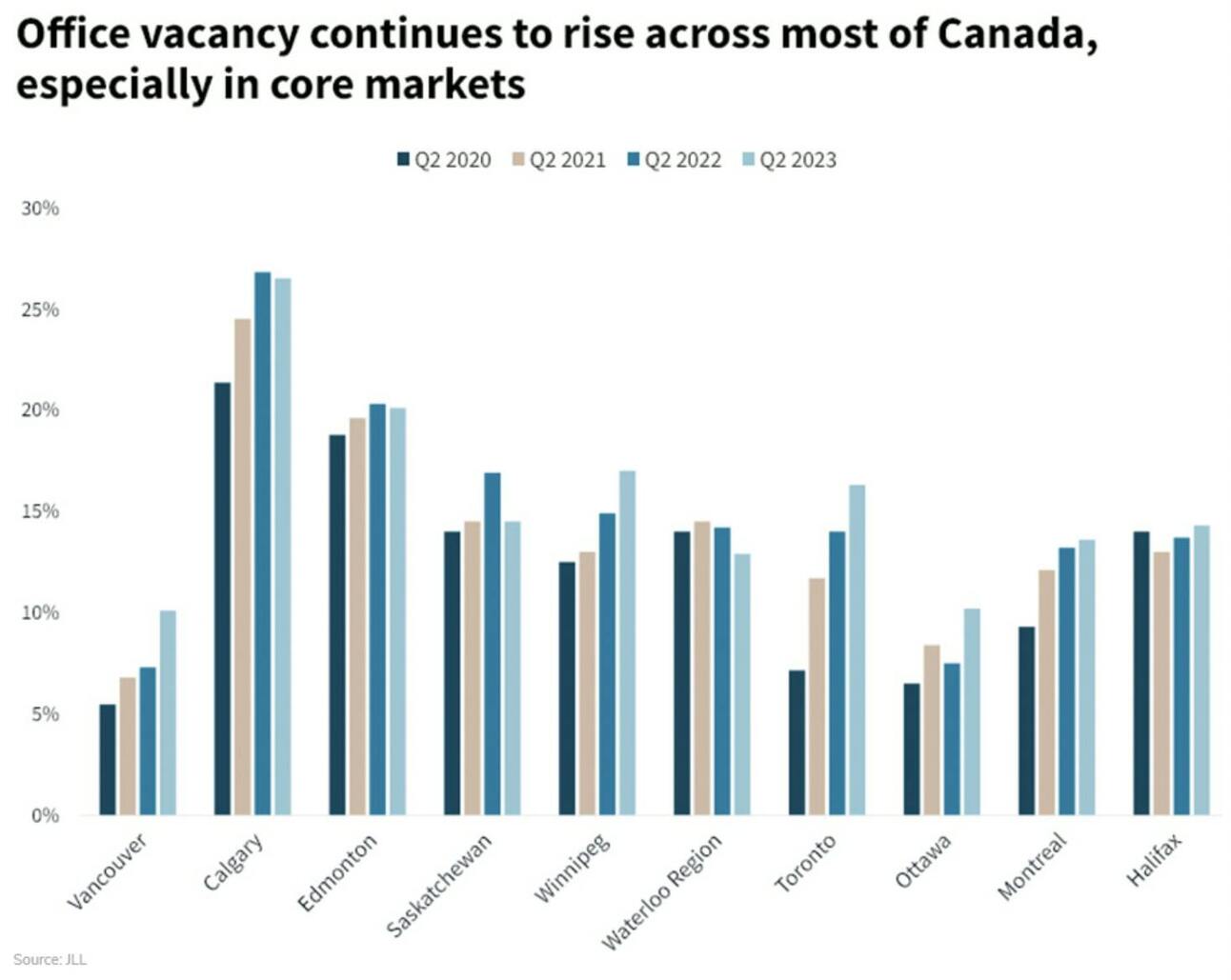

🏢 Commercial Real Estate Outlook for 2024

Commercial real estate reported a weak year, but activity is expected to bounce back in 2024.

The industrial sector remained the strongest sector in the GTA, reporting $5.4 billion in dollar volume transacted, a minimal decrease of 2% year-over-year.

The multi-family sector reported a 57% decrease year-over-year

Office transactions continued to drop in Q3 2023, with only $2.7 billion in dollar volume transacted (a 22% decrease year-over-year).

Hotels are gaining attention, particularly as there are municipal efforts to restrict Airbnb and short-term rentals.

Why This Matters: The industrial real estate sector has remained strong throughout the pandemic, with escalating lease rates and low vacancies. Well-situated warehouses and small bay industrial spaces are in high demand.

While the office market has faced challenges in recent years, it may become more attractive for buyers, especially those seeking long-term investments as pricing expectations align.

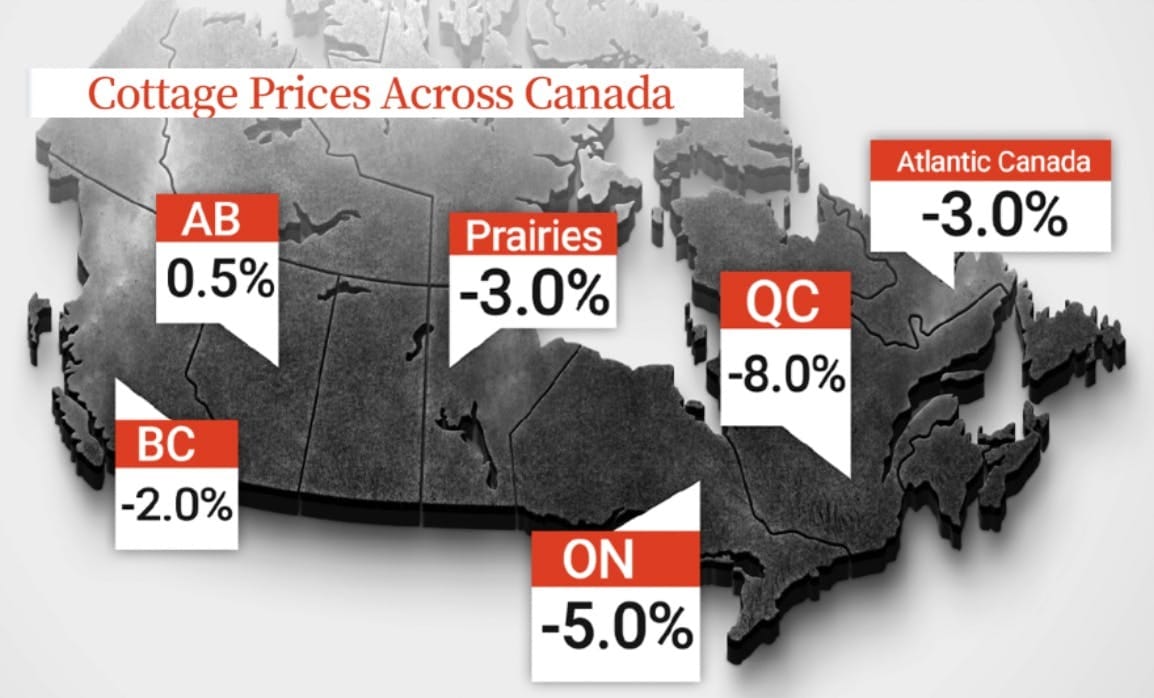

🛖 Why Now is a Great Time to Buy a Cottage

Cottage prices have declined, with demand returning to levels seen in 2018 or 2019.

The Muskoka area has experienced a 16% price decline from the previous year.

Ontario’s Southern Georgian Bay saw the biggest decline in the price of a single-family detached home, dropping 10.1%. British Columbia’s ski regions saw a drop of 1.6%, while Alberta’s Canmore showed an increase of 9.6%, and Quebec’s ski regions increased by 7.8%.

Based on the same report, the price of a single-family detached home is forecasted to increase by 2.9% in the coming year.

Why This Matters: 2024 could be the right time to purchase a cottage due to reduced demand and lower prices in recreational parts of Ontario. Interest rates are expected to remain steady, and not increase further. This, coupled with the potential for future rate cuts, could lead to a rise in the winter recreational market’s inventory and supply.

🏭 Hydrogen Industry Drives Real Estate Opportunities in Alberta

Alberta’s hydrogen industry is expected to experience significant growth, driving demand for industrial land in Edmonton and the province's northern regions.

Alberta is the largest producer of hydrogen in Canada, manufacturing approximately 2.5 million tonnes per year

The government of Alberta identifies hydrogen as a potential energy export that can fuel economic opportunity and job creation.

Major companies such as Air Products, Suncor, and ATCO are investing in hydrogen and petrochemical projects in northern Alberta, contributing to the demand for industrial land.

Air Products (US Based company) is building a $1.6-billion complex in northeast Edmonton that will convert natural gas to hydrogen.

Why This Matters: The demand for hydrogen is expected to increase from 92 million tonnes in 2022 to 500 million tonnes by 2050. The government's focus on developing the hydrogen sector as an energy export presents the potential for economic and real estate growth in Alberta.

Major companies like Air Products, Suncor, and ATCO investing in hydrogen and petrochemical projects contribute to the overall growth of the sector.