- Urban 411

- Posts

- Your Weekly 411: Canadian Markets with The Biggest Price Drops | Toronto's Proposed 10-16% Tax Hike | Record-High Downtown Office Vacancy Rates

Your Weekly 411: Canadian Markets with The Biggest Price Drops | Toronto's Proposed 10-16% Tax Hike | Record-High Downtown Office Vacancy Rates

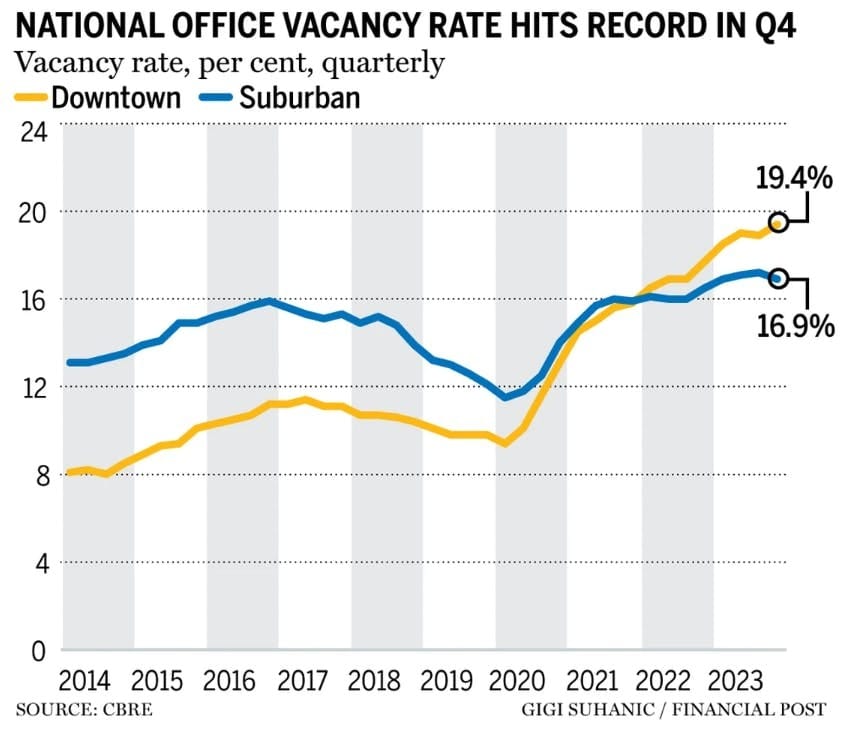

Record-High Downtown Office Vacancy Rates

The Weekly 411

TLDR:

📉 Canadian Real Estate Markets with The Biggest Price Drops

🏢 Record-High Downtown Office Vacancy Rates in Canada

💰 Toronto's Proposed 10-16% Tax Hike for Homeowners

🏠 Brampton Implements Residential Rental Licensing Program

📉Market Update: Communities with Biggest Price Drop

Real estate prices in several Ontario markets have declined since June, with communities in southern Ontario experiencing the biggest drops.

Kitchener-Waterloo witnessed the largest nationwide drop with home prices dropping 8.9% since June to $708,600 in November, a 0.6% decrease compared to the previous year.

The GTA experienced a 7.7% drop in prices since June, with the benchmark price reaching $1,081,300, a 0.1% decrease from the previous year.

Other communities such as London, St. Thomas, Hamilton, Burlington, and Guelph experienced declines of over 7% since June, while the Niagara Region saw a drop of nearly 5%.

💰 Toronto's Proposed 10-16% Tax Hike for Homeowners

The 2024 operating budget for Toronto includes a 10.5% property tax increase.

The tax hike would require the average homeowner to pay close to $400 more per year.

If the city doesn't receive $250 million in funding from the federal government an additional 6% increase, resulting in a total tax hike of 16.5%.

Toronto is facing an $18 billion deficit, largely due to transit and shelter costs that have increased due to the pandemic and immigration

Why This Matters: Toronto's infrastructure continues to face decline due to a growing backlog of repairs and improvements. The proposed budget addresses areas such as police funding, mental health crisis response, shelter services, and transit. If the tax hike passes, the average property tax bill in 2024 would be $3,940.

🏢 Record-High Downtown Office Vacancy Rates in Canada

Canada's downtown office vacancy rate reached a record high of 19.4% at the end of 2023

Office owners are looking to convert existing properties to other uses, such as housing However, the repurposed office space constitutes only 0.5% of the total inventory.

The demand for office space has improved in B.C., Alberta, and Atlantic Canada, while softening in most of Ontario and Quebec.

Vancouver has positive net absorption and an overall vacancy rate of 11%, making it the office market with the best conditions in North America.

Montreal has stable vacancy rates, but the under-construction pipeline is nearly fully leased.

Halifax has shown positive net absorption for seven consecutive quarters, with strong demand for co-working spaces

🏠 Brampton Implements Residential Rental Licensing Program

To curb illegal rental, Brampton implemented a Residential Rental Licensing (RRL) program which requires random inspections of rental units in select wards.

Effective January 1, 2024, owners of 1 to 4 residential unit rentals are required to obtain a license, which costs $300 annually.

Additional Residential Units (ARUs) must be registered before eligibility for an RRL license.

The program covers registered second units, unregistered rentals, and ARUs in specific wards, subject to random inspections.

Why This Matters: Landlords and real estate investors should pay attention to this program as it signals a shift towards increased accountability and the need to maintain safe and well-maintained rental properties. Understanding and complying with these regulations is crucial for landlords to avoid penalties and legal implications.