- Urban 411

- Posts

- Your Weekly 411: End of Year Market Update| Canada Reports Fastest Population Growth in History | Toronto Receives $471M from Gov Housing Fund

Your Weekly 411: End of Year Market Update| Canada Reports Fastest Population Growth in History | Toronto Receives $471M from Gov Housing Fund

Toronto Receives $471M from Gov Housing Fund

The Weekly 411

TLDR:

🏠 End of Year Market Update

📈 Canada Reports Fastest Population Growth in History

💸 Canadian Homeowners Face Ultimatum from Private Lenders

💼 Toronto Receives $471 Million from Government's Housing Fund

🏠 End of Year Market Update

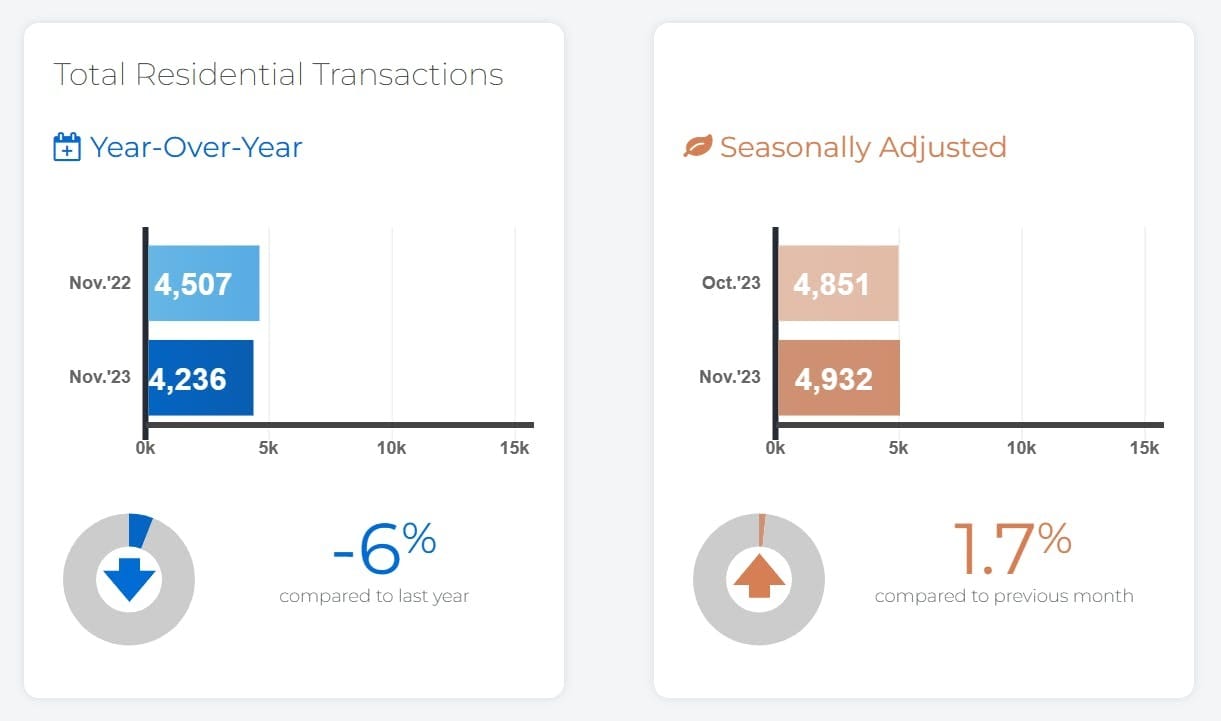

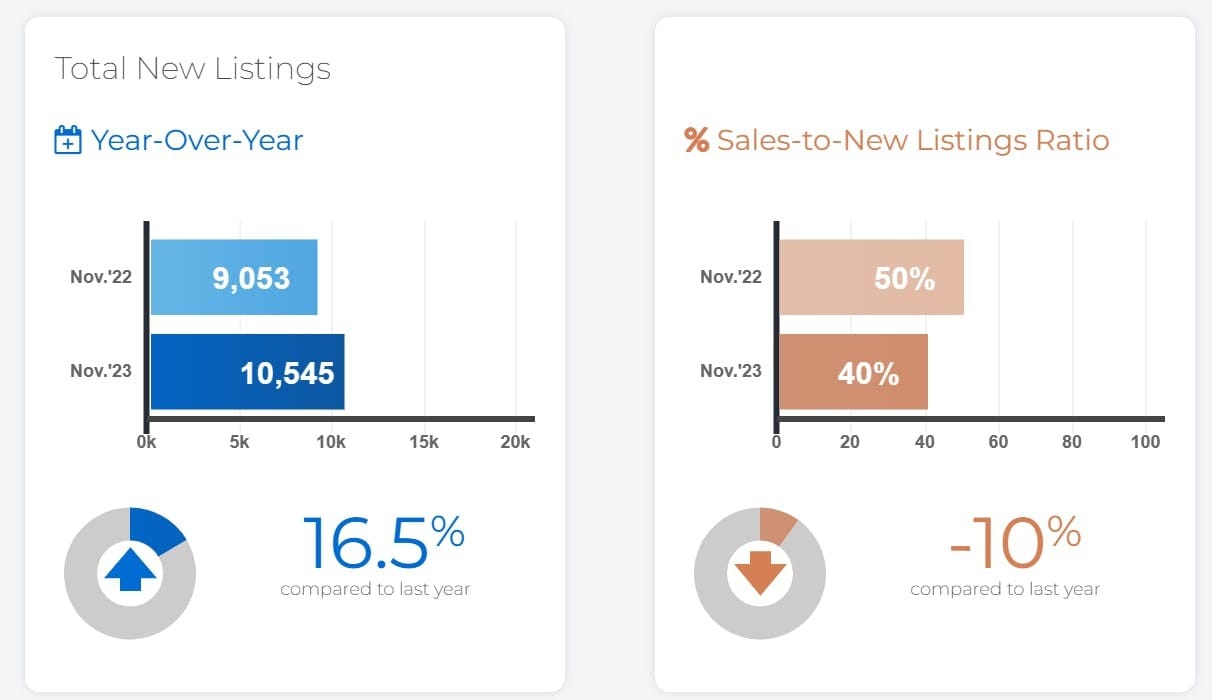

Year-over-year sales in 2023 declined by six percent, while new listings increased by 16.5 percent.

Selling prices remained flat year-over-year, influenced by inflation and elevated borrowing costs.

The MLS Home Price Index (HPI) benchmark decreased by 1.7 percent on a seasonally adjusted monthly basis, and the average selling price decreased by 2.2 percent month-over-month.

Why This Matters: Anticipated decreases in mortgage rates, coupled with ongoing population growth, are expected to result in increased demand compared to housing supply. This heightened demand may contribute to a resurgence in home prices. Projected relief is foreseen, driven by expectations of lower bond yields and potential rate cuts by the Bank of Canada in the first half of 2024.

📈 Canada Reports Fastest Population Growth in History

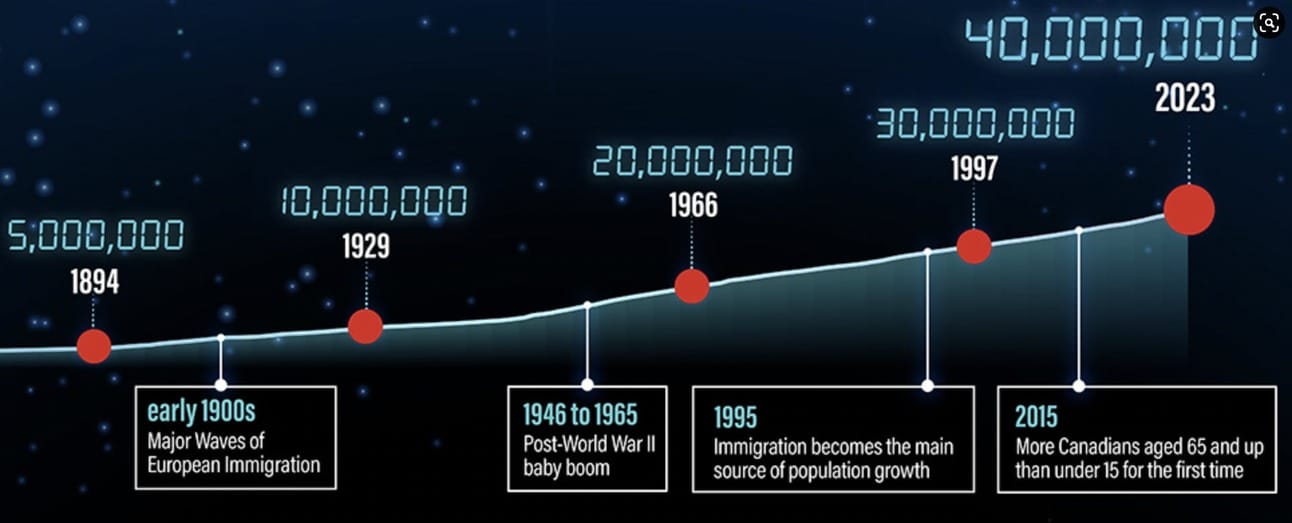

Canada welcomed 107,972 immigrants in Q3, marking the country's highest growth in population since 1957

Population growth rates in the same period exceeded the national level (+1.1%) in several provinces:

Alberta experienced a growth rate of +1.3%.

Prince Edward Island saw a growth rate of +1.2%.

Ontario also had a growth rate of +1.2%.

Almost all (96%) of Canada’s current population growth is attributed to immigration.

Alberta has been a significant attractor of interprovincial migrants, with interprovincial migration gains of 10,000 or more for five consecutive quarters.

Why This Matters: The substantial immigration-driven population growth, especially in provinces like Alberta with a 1.3% growth rate, indicates a potential surge in housing demand. For real estate investors, this signifies a growing market with opportunities for property investments and potential appreciation.

Canada's Historical Population Growth Since 1894

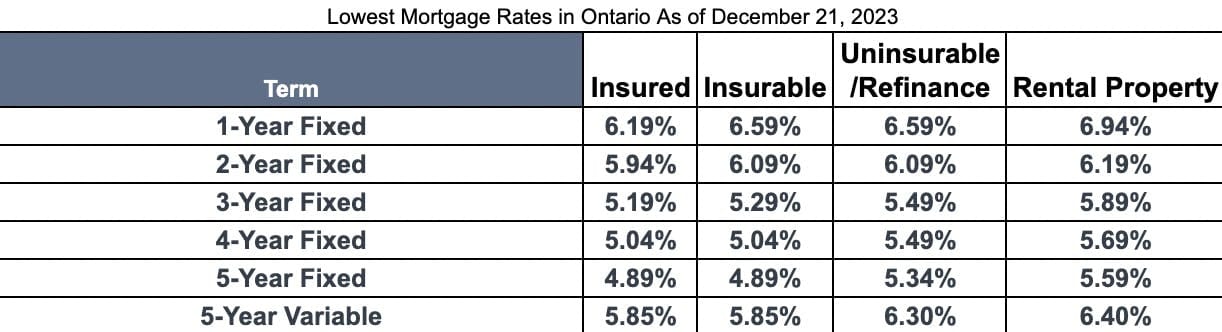

💸 Canadian Homeowners Face Ultimatum from Private Lenders

Private lenders are demanding that delinquent Canadian homeowners fulfill their mortgage obligations.

The rise in delinquent borrowers has led to an increase in listings.

More borrowers are turning to alternative lenders due to the absence of the federally mandated mortgage stress test.

Private lenders had nearly 0.9% of their mortgages in arrears during Q1, compared to just 0.15% for chartered banks.

Why This Matters: It emphasizes the rise in homes listed for sale due to delinquent borrowers and the pressure from alternative lenders. Real estate investors and home buyers can analyze this trend to gauge the potential impact on inventory levels, housing prices, and market dynamics in specific regions.

💼 Toronto Receives $471 Million from Federal Government's Housing Accelerator Fund

The federal government announced a $471-million housing agreement with Toronto, marking the largest payment from Ottawa’s Housing Accelerator Fund

The fund requires cities to relax zoning rules, particularly those protecting neighborhoods dominated by single-family homes.

The fund’s purpose is to accelerate housing approvals, create affordable housing, protect rental stock, and increase density in existing sites.

The week’s announcements include agreements with Burnaby, Mississauga, Vancouver, and Winnipeg, bringing the total commitment to $864 million.

Why This Matters: The injection of $471 million provides a boost to Toronto's efforts to address housing challenges. The Toronto housing agreement adds another potential asset class for real-estate investors. Businesses related to construction, infrastructure, or services that support the real estate industry will also experience increased demand.