- Urban 411

- Posts

- Your Weekly 411: 10% Decline in Home Prices Forecasted for 2024 | Canada Revives Wartime Plan to Tackle Housing Crisis | Mortgage Stress Test Unchanged for Third Year in a Row

Your Weekly 411: 10% Decline in Home Prices Forecasted for 2024 | Canada Revives Wartime Plan to Tackle Housing Crisis | Mortgage Stress Test Unchanged for Third Year in a Row

Mortgage Stress Test Unchanged for Third Year in a Row

The Weekly 411 TLDR: 📉 Buyers' Market Ahead: 10% Decline in Home Prices Forecasted for 2024 💸 Mortgage Stress Test Unchanged for Third Year in a Row 🛠 Canada Revives Wartime Plan to Tackle Housing Crisis 💼 New Opportunity: Northern Ontario Town is Offering Land to Homebuilders for $10 |

📉 Buyers' Market Ahead: 10% Decline in Home Prices Forecasted for 2024

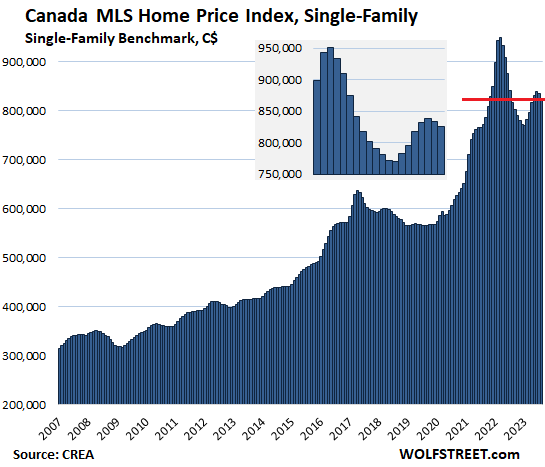

TD predicts that average home prices in Canada could drop by as much as 10% in early 2024.

Ontario's sales-to-new listings ratio (SNLR) dropped to 39% in October from 63% in May, primarily due to a sudden surge in supply and a decline in sales.

The increase in the months of inventory suggests that it would take 4.1 months to sell all listed properties at the current sales pace.

Demand is expected to rise in Q2 of 2024 due to expected rate cuts and population growth.

Why This Matters: The expected drop in prices is largely due to a surge in housing supply in BC and Ontario. Weaker growth or higher-than-expected interest rates are identified as important downside risks to the housing market outlook. However, with a 10% drop in home prices, the Canadian housing market would still be well above pre-pandemic levels.

💸 Mortgage Stress Test Unchanged for Third Year in a Row

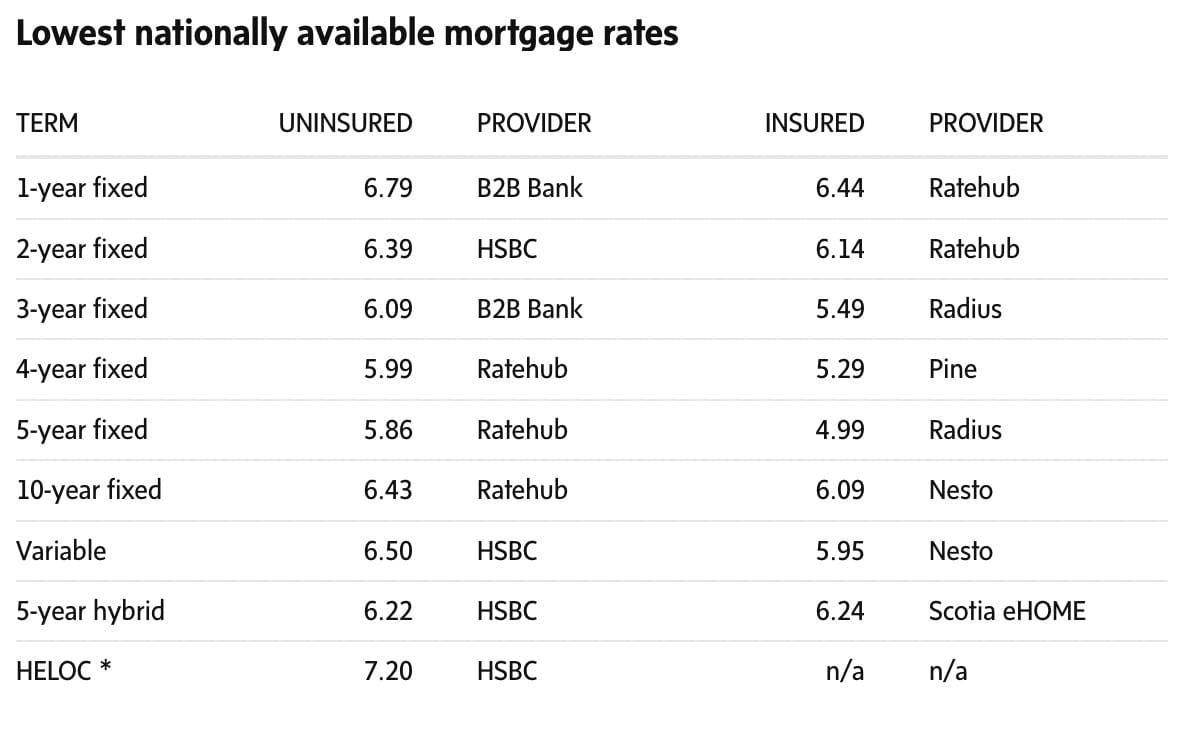

Canada's bank has decided to keep the mortgage stress test unchanged for the third consecutive year.

The minimum qualifying rate (MQR) for uninsured mortgages remains at 5.25% for uninsured borrowers who have made a down payment of at least 20% of the property's purchase price.

Critics argue that the current MQR of 5.25% is irrelevant when mortgage rates are around 6%

In 2023, 39% of new mortgages were issued by alternative lenders (not banks), compared to only 27% in 2020.

Why This Matters: Higher lending costs have led borrowers to seek loans from alternative lenders, contributing to a slowdown in home sales. Higher borrowing costs have led borrowers to seek loans from alternative lenders. Going forward, borrowers will be able to skip the stress test when renewing their mortgages with different lenders.

🛠 Canada Revives Wartime Plan to Tackle Housing Crisis

The Canadian government is reviving the wartime housing effort to rapidly build affordable housing.

This measure was implemented after the Second World War to address housing shortages when soldiers returned home.

The goal is to have a pre-approved design catalog ready for builders to use by fall 2024, with new homes being built as early as 2025.

The initiative focuses on building low-rise construction designs, including modular and prefabricated home

Why This Matters: Estimates suggest that this initiative could potentially shorten construction time for new housing by up to one year. The initiative is expected to benefit struggling communities such as students and the elderly by providing affordable options. Investors can also benefit from this initiative, as it may provide more opportunities for investment in cost-effective and sustainable housing projects.

💼New Opportunities: Northern Ontario Town is Offering Land to Homebuilders for $10

The Town of Cochrane in Ontario is proposing to sell residential lots for as low as $10 as part of a rebate program.

The municipality owns roughly 400 vacant lots that will be sold at discounted prices, starting from $10.

To be eligible for the program, buyers must agree to build a home on the purchased lot.

The specific details of the tax rebate portion of the program are still being finalized, with a planned launch in January 2024.

The rebate program is a response to the area's growing mining industry, which is expected to create a demand for over 1000 employees.

Why This Matters: Cochrane's proposal to sell residential lots for as low as $10 presents a compelling opportunity, offering an affordable entry point and potential for property appreciation. With a focus on incentivized development and a tax rebate program in the works, investors may find this initiative attractive for capitalizing on the town's anticipated economic growth driven by the expanding mining industry.

Town of Cochrane in Northeastern Ontario